The Lost Decade - Sometimes Zero is Your Hero!

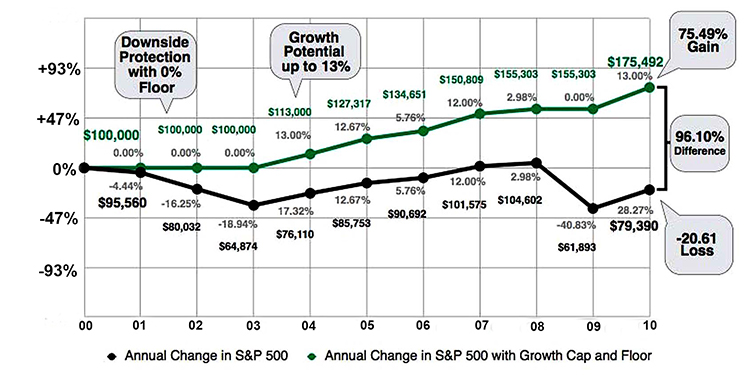

The chart below compares owning the actual S&P (excluding dividends from the underlying stocks) with an IUL index strategy of one-year point to point, zero floor and 13% earnings cap, for the period from the beginning of 2000 through the beginning of 2010.

Note that while in 2 of the ten years (2003 and 2009) the IUL only grew by 13% as compared to over 17% and 28% respectively for the actual S&P, there were four years where the actual S&P fell. In those down years, the IUL would not suffer any investment loss.

At the end of ten years, $100,000 placed in the actual S&P would have fallen by more than 20% to $79,390. The same $100,000 in the IUL strategy would have grown more than 75% to $175,492. In other words, you would have had 96% more money at the end of ten years with IUL as compared to directly buying the S&P.

By not ever losing money and consequently never having to climb back from a deep hole, sometimes zero is your hero! (Back to IUL Table of Contents)

|